Brexit and the housing market

Earlier this year, after the triggering of Article 50, the process whereby the UK will leave the EU within two years, one search term stood above others in Google’s ranking.

Their ranking showed that ‘How will Brexit affect…House prices and mortgages’ was a more popular concern then any search terms related to ‘pound’, ‘economy’ or ‘interest rates’. With millions of home owners and potential first-time buyers looking on anxiously, the housing market seemed more uncertain then ever.

However, the UK housing market is standing apart from the wider economic concerns surrounding Brexit, The Guardian reports. What the Brexit headlines aren’t telling you, is that there are in fact more buyers and sellers in the market compared to this time last year, when the referendum took place, with sales agreed rising by 4.6% in June 2017 compared to June 2016.

Miles Shipside, Rightmove director and housing market analyst, alongside the sites latest property survey, said “A year on from the shock referendum result and subsequent dent in activity levels, the fundamentals remain strong. Low unemployment, low interest rates, strong demand and historic undersupply of homes are mitigating any wobbles in confidence and as a result nearly half the properties on the market, over 45%, have sold signs slapped across them.”

Fionnuala Earley, Chief Economist at Countrywide, has said that ‘The expectation, pre-referendum, that house prices would collapse was very wide of the mark.’ It seems to be becoming clear that the market’s biggest reaction to Brexit negotiations mirrored that of the public; in the immediate aftermath of the referendum. The length of time the Brexit process will take, up to all of 2 years, also means there shouldn’t be any nasty surprises. Which falls in line with what Brian Murphy, head of lending for Mortgage Advice Bureau, has to say;

“The average time to sell…has remained broadly unchanged for the last quarter, (which) points to market consistency in most areas that again, flies in the face of some who might suggest that the market is in negative territory. Quite to the contrary, all of these indicators would point to a calm, steady and functioning UK market.”

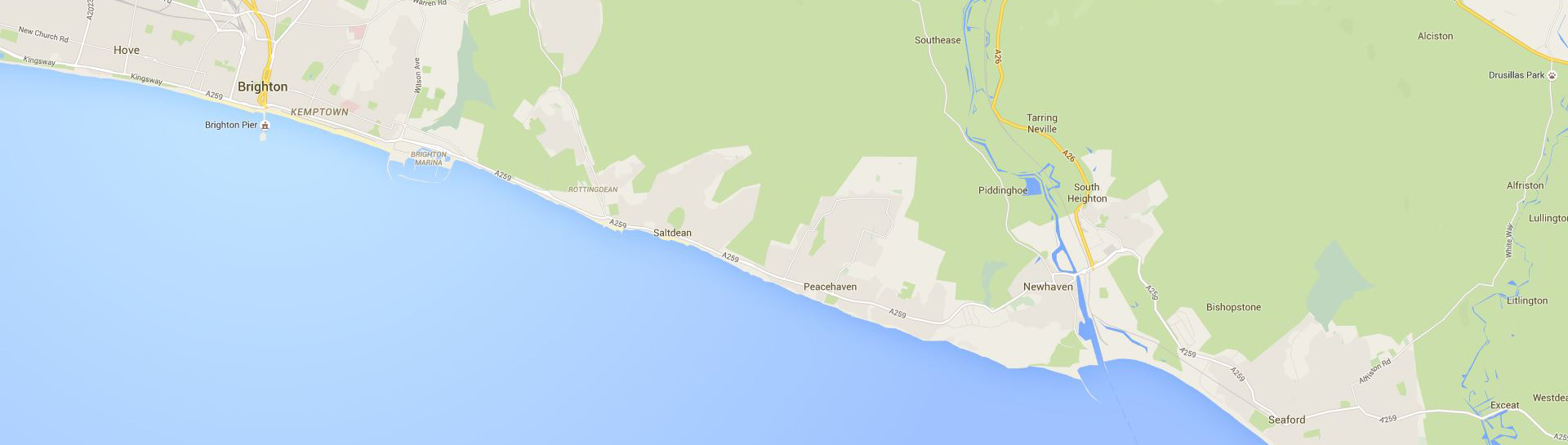

Location wise, in East Sussex and the Brighton coastal region, consumer demand is only going to remain high in such sought after areas. All the while mortgage rates are still sat at low levels, and are expected to remain low for some time yet. It seems like, despite Brexit, now seems like as good a time as any to have a stake in the housing market. For us Brits, it really is a case of keeping calm and carrying on.